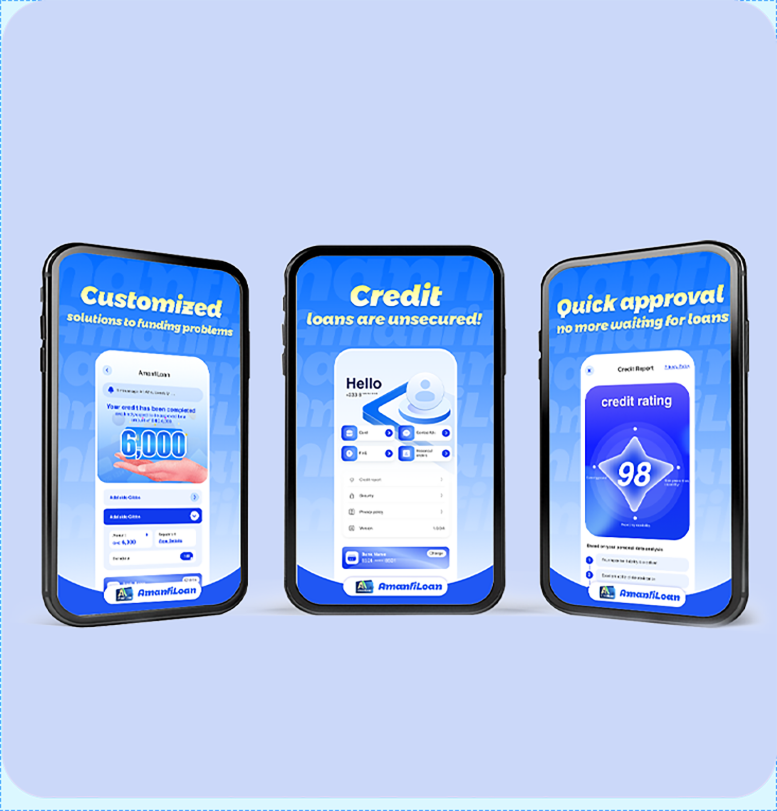

Why choose AmanfiLoan?

- Fast approval: It only takes a few minutes to complete the application process, and the loan will be released to your account within 1 hour at the fastest.

- Flexible borrowing: Whether you need short-term turnover or long-term financial support, we provide a variety of loan solutions to meet your different needs.

- No collateral required: Pure credit loan, easy borrowing, no cumbersome guarantee process.

- Safe and reliable: Using bank-level encryption technology to protect your personal information and transaction security.

Download AmanfiLoan App

Start a new life of smart finance!

How to get started?

- Download the app: Go to Google Play Store or Apple App Store to download and install the AmanfiLoan app.

- Register an account: Enter your mobile account to complete the registration process.

- Submit a loan application: Fill out the loan application form according to the prompts and upload the required documents.

- Wait for approval: Our system will review your application in the shortest possible time and notify you of the result.

Download AmanfiLoan

and embrace a better life

Low interest benefits the people and reduces the burden.

AmanfiLoan adheres to the concept of inclusive finance and is committed to providing low-interest loan services to Ghanaian users. Compared with similar products on the market, our loan interest rates are more competitive and there are no hidden fees. Borrowing 6,000 Ghana Cedis, the lowest daily interest rate is only 3.2 Ghana Cedis, allowing you to solve financial problems at a lower cost and use more funds to improve your life and career development.

Flexible loan amount, diverse choices Everyone's financial needs are different. AmanfiLoan provides flexible loan amounts, ranging from 100 Ghana Cedis to 6,000 Ghana Cedis, allowing you to freely choose according to your actual situation. The repayment period is also very flexible, with a minimum of 91 days and a maximum of 180 days. You can customize your own repayment plan according to your income cycle to avoid excessive repayment pressure and make the loan a real tool to help your life.

Questions about us

View detailsAs long as you are a legal resident of Ghana who is over 18 years old and has a stable source of income, you can apply. Whether you are an office worker, self-employed, or a freelancer, as long as you can prove that you have a continuous income, you can submit an application. We do not restrict specific occupations or income types.

After the review is passed, the funds will usually be credited to the account in 3 minutes at the fastest. However, due to force majeure factors such as bank system maintenance and network fluctuations, there may be a slight delay in rare cases. If the funds have not been credited within 30 minutes, you can contact customer service at any time to inquire.

We use bank-level encryption technology to protect your personal information, and all data is stored in a secure server. Without your authorization, your data will never be sold or shared with any third party. We strictly comply with Ghana's financial regulatory regulations to protect your privacy.

Repaying on time helps improve your credit rating, thereby increasing your loan amount. Generally, the system will automatically evaluate your repayment record and credit status every 3 months. If you meet the requirements, your loan amount will be automatically increased without the need for additional application.